Story Highlights

- Investors with a personal financial adviser are more confident

- They also are more likely to rate themselves well on investment knowledge

- Many investors are not using basic investment tools and strategies

WASHINGTON, D.C. -- More than half of American investors (55%) use a personal financial adviser (PFA). Investors who use a PFA are more likely to have confidence in their investment plans and in their own knowledge of stock investing than those who handle their own finances.

| Have a PFA | Do not have a PFA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Strongly agree their investment plan is on the right track | 61 | 41 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Give themselves an A or B grade on knowledge of stock investing | 44 | 32 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Strongly agree they feel prepared for a market correction | 39 | 24 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Have a written financial plan to guide their financial decision-making | 68 | 28 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Have a diversified investment portfolio | 86 | 63 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rebalance their investment portfolio at least once a year | 54 | 33 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WELLS FARGO/GALLUP INVESTOR AND RETIREMENT OPTIMISM INDEX, July 28-Aug. 6, 2017 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

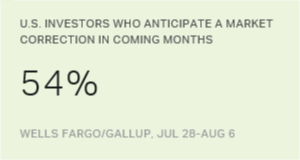

A solid majority (61%) of investors who work with a PFA strongly agree that their investment plan is on the right track, in comparison to 41% of investors without a PFA who feel the same. Additionally, investors with a PFA are more likely to see themselves as able to handle the next stock market correction -- something that more than half of all investors (54%) expect to occur before the end of the year.

Investors with PFAs also differ from those without one in the likelihood they practice several investment habits generally considered wise:

- They are more than twice as likely to have a written plan to guide their financial decision-making -- 68% vs. 28%.

- More than eight in 10 investors with PFAs (86%) say they maintain an investment portfolio that is diversified "across different industries, asset categories and risk levels," compared with 63% of those without PFAs.

- Just over half of investors with PFAs (54%) say they rebalance their investment portfolio (buying or selling funds in order to restore the portfolio to its original asset allocation) at least once a year. This compares with 33% of those without PFAs.

Further, investors with a PFA are more likely than those without one to give themselves a grade of A or B on their own knowledge of stock investing -- 44% vs. 32%, respectively.

The findings are from the third-quarter Wells Fargo/║┌┴¤═° Investor and Retirement Optimism Index survey, conducted July 28-Aug. 6. The survey reflects the views of U.S. investors with $10,000 or more invested in stocks, bonds or mutual funds.

║┌┴¤═° Analytics

Subscribe to our online platform and access nearly a century of primary data.

Many Investors Not Using Basic Methods, Strategies for Investment

Investors with at least $100,000 in stocks, bonds or mutual funds are much more likely to use a PFA (65%) than are those whose investments total less than $100,000 (41%). Despite relatively widespread usage of PFAs by investors at both levels, there is far from unanimous adoption of wise investment habits:

- About half (51%) of all investors do not take the basic step of creating a written plan to guide them in their financial decision-making.

- A similar proportion (51%) rebalance their portfolio only every few years, if at all.

- About one-fifth say their portfolios are not diversified.

- Twenty-two percent say they could tolerate taking more risks with their investments than they currently do. In avoiding such risks, even though they could tolerate them, these investors are potentially denying themselves additional income.

Bottom Line

Investors are more confident in their investing and are more likely to take solid investing actions if they use a personal financial adviser. Regardless of whether this is because an active, confident investor is more likely to hire a PFA or because an investor who uses a PFA is therefore more confident and more active, it is clear that having a PFA is linked to positive investment actions and attitudes.

In spite of the connection, many investors, including higher proportions of those who grade themselves poorly on personal knowledge of stock investing, choose not to use PFAs. The choice to "go it alone" is only one of a number of decisions American investors are making that leave them underutilizing or ignoring altogether some of the most basic financial tools and strategies.

Survey Methods

Results for the Wells Fargo/║┌┴¤═° Investor and Retirement Optimism Index survey are based on questions asked July 28-Aug. 6, 2017, on the ║┌┴¤═° Daily tracking survey, of a random sample of 1,006 U.S. adults having investable assets of $10,000 or more.

For results based on the total sample of investors, the margin of sampling error is ±4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 70% cellphone respondents and 30% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.