Story Highlights

- 25% of those aged 18 to 29 plan to rely on Social Security in their retirement

- This is nearly twice the 13% in age group who said this in 2007

- Older nonretirees are also more likely to plan on Social Security

WASHINGTON, D.C. -- Since 2001, nonretired Americans have become somewhat more likely to say in their retirement. This increase in projected reliance on Social Security is apparent among both younger (aged 18 to 29) and older (aged 50 to 64) nonretired Americans. Views of those aged 30 to 49 remain essentially unchanged.

These data are based on interviews conducted in April of each year as part of ║┌┴¤═°'s Economy and Personal Finance survey, with a total of more than 18,000 interviews from 2001-2017. This analysis uses three-year rolling averages to smooth out year-to-year fluctuations resulting from smaller sample sizes within age groups.

Younger Americans Less Likely Than Those Who Are Older to Say They Will Depend on Social Security

Over the past 16 years, younger Americans have consistently been less likely than older Americans to say they will rely on Social Security when they retire. This may reflect what young people read, see and hear about the long-term future of Social Security. Experts estimate the Social Security trust fund will run out by the mid-2030s, meaning that, without payroll tax increases or economic growth exceeding expectations, benefits would need to be cut.

Those currently younger than 30 will first reach age 62, the earliest possible year to get Social Security benefits under current law, in 2049.

Exactly what benefits Social Security will be able to provide them at that point is uncertain, which means there is some logic in young people's lower inclinations to say the program will be a major source of their retirement income. Previous ║┌┴¤═° research has shown that almost two-thirds of those younger than 50 when they retire.

Although 18- to 29-year-olds remain less likely than older Americans to say Social Security will be a major source of their retirement income, their projected reliance on Social Security has edged up during the past 16 years. This has occurred even as Congress and previous presidents have taken no significant steps to address the looming issue of projected shortfalls in Social Security funds. Underscoring the reluctance of Washington to deal with the issue, President Donald Trump's newly proposed budget doesn't touch Social Security retirement benefits, although it does include cuts to disability payouts.

Older Americans' consistently greater projected reliance on Social Security in retirement may simply reflect their realistic expectation that any future shortfall won't occur in time to affect them personally. Unlike those younger than 50, a significant majority of those 50 to 64 have said previously that . Older people may also realize they are not going to have as much money saved as they may have thought, increasing their awareness that Social Security will provide a major source of their retirement income.

Majority of Retirees Still Say Social Security Is Major Source of Income

Over the past 16 years, a majority of retirees have consistently reported that Social Security is a major source of their own retirement income. Despite all that has happened to the economy and the stock market since 2001, including the Great Recession and the subsequent rebounding stock values, this reliance on Social Security has not changed materially. Given the slight rise in nonretirees' projected dependence on Social Security, the wide gap between current retirees' reported dependence on Social Security today and the projected reliance among those not yet retired has narrowed slightly in recent years.

Overall Reliance on Social Security Up as Reliance on 401(k)s Edges Downward

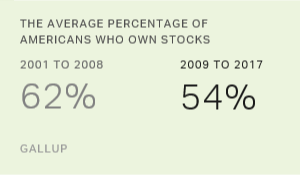

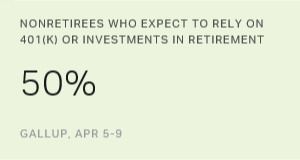

Despite recent record stock market gains, the percentage of nonretirees saying they will depend on 401(k)s as a major source of retirement income has not returned to where it was before the financial meltdown in 2008. This could partly reflect the . Projected reliance on Social Security has remained at its slightly elevated level.

This shift in projected sources of income has been most notable among those aged 50 to 64. In the years immediately before the recession, older nonretirees were generally more likely to say their 401(k)s would be a major source of retirement income than to say this about Social Security. In recent years, that changed. Projected reliance on Social Security has risen, while reliance on 401(k)s has fallen, leaving the former as the projected more important source.

Bottom Line

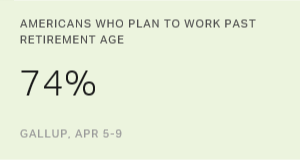

The structure of retirement in the U.S. has changed significantly in recent decades, with a decline in pension plans and with a substantial, although slightly declining, percentage of workers who now say they will when they reach traditional retirement age. And, even though the long-term solvency of the Social Security system remains unclear, Americans have become slightly more likely to say they will depend on it in retirement than they were in the past. If the Social Security system isn't fixed, many of today's workers may be in for a shock, because those who are already retired are substantially more likely to say Social Security is a major source of income for them now than nonretirees project it will be for them in the future. This discrepancy has been evident for the 16 years that ║┌┴¤═° has been tracking these attitudes.

These data are available in .

Survey Methods

Results for this ║┌┴¤═° poll are based on combined telephone interviews from ║┌┴¤═°'s annual Economy and Personal Finance survey, conducted each April from 2001 through 2017. The combined sample is based on interviews with 18,336 randomly selected adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on samples combining three years of interviewing, or approximately 3,000 national adults, the margin of sampling error is ±3 percentage points at the 95% confidence level. The margin of sampling error is higher for the smaller samples of specific age groups.

All reported margins of sampling error include computed design effects for weighting.

Learn more about how the works.