The following is based on the recently released 2017 Global Findex report.

Since its launch in 2011, the Global Findex database -- which is based largely on survey data collected in more than 140 countries through the ║┌┴¤═° World Poll -- has provided insights into ways to increase financial inclusion around the world. However, the is the first to feature data on mobile phone ownership and access to the internet, revealing the extent to which mobile phones and the internet have created new opportunities for providing ´Čünancial services. Relatively simple, text-based mobile phones allow the use of mobile money accounts, while smartphone technology provides a convenient means for people to make transactions from their ´Čünancial institution account.

Eight in 10 Residents of Developing Economies Now Have Mobile Phones

According to 2017 ║┌┴¤═° World Poll data, 93% of adults in high-income economies have their own mobile phone, compared with 79% in developing economies. However, ownership rates vary considerably among the world's largest developing economies; in India, for example, 69% of adults have a mobile phone, but that figure rises to 85% in Brazil and 93% in China.

Within many of these developing economies, there are also gender divides. Overall, women in developing economies are less likely than men to have a mobile phone -- 74% vs. 84%, respectively. The gap is bigger in some economies; in Pakistan, for example, men are more than twice as likely as women to have a mobile phone. Yet several developing economies have no appreciable gender gap, including Brazil, China, Colombia, Indonesia and Turkey.

Not surprisingly, there is also a gap in mobile phone ownership between richer and poorer adults. Globally, 85% of adults living in the richest three-fifths of households within countries have a mobile phone, compared with 76% of those living in the poorest two-fifths. Bigger gaps are found in the developing world, particularly sub-Saharan Africa. Ethiopia, Mozambique, Tanzania and Zambia are among the economies where the gap is 20 percentage points or more. In Ivory Coast, however, the share of poorer adults who have a mobile phone, at 75%, is roughly the same as the share of wealthier adults who have one.

Four in 10 in Developing Economies Have Mobile Phone and Internet Access

Having access to the internet as well as a mobile phone brings a wider range of ´Čünancial services within reach. In high-income economies, 82% of adults have both a mobile phone and access to the internet, indicating a likelihood that they have access to app-based mobile phones or online payments. In developing economies, 40% of adults -- or about half of mobile phone owners -- have access to both technologies.

In developing economies, while 43% of men have both a mobile phone and access to the internet, 37% of women do. Men are twice as likely as women to have access to both of these technologies in some economies, including Bangladesh, Ethiopia and India. But men and women have equal access in China, Colombia and South Africa.

Wealthier adults are more likely than their poorer counterparts to have access to both a mobile phone and the internet. In the developing world, 48% of adults in the richest three-fifths of households within countries have these technologies, while 28% of those in the poorest two-fifths do. In some cases the gap is significantly wider; in Kenya it is nearly twice as large at 39 percentage points; in Colombia it is 29 percentage points.

Implications

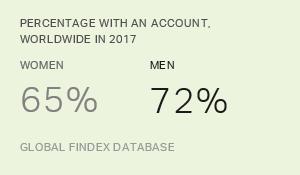

Global Findex data show that about 1.1 billion unbanked adults worldwide -- about two-thirds of all those without a bank account -- have a mobile phone. Though access to the internet is far less common at 25% of unbanked adults, internet infrastructure is expanding rapidly in many developing countries.

Technology is only part of the picture with regard to financial inclusion. To ensure that people bene´Čüt from digital ´Čünancial services, governments need to ensure that appropriate regulations and consumer protection safeguards are in place. And regardless of the technology used, ´Čünancial services need to be tailored to the needs of disadvantaged groups such as women, poor people and ´Čürst-time users.

Nonetheless, Global Findex data suggest that mobile phones and the internet could go a long way toward helping to overcome some of the barriers that unbanked adults say prevent them from accessing ´Čünancial services. For example, digital ´Čünancial services might shrink the distance between ´Čünancial institutions and their customers. And by lowering the cost of providing ´Čünancial services, digital technology might be helpful for the large share of unbanked adults who cite high costs as a reason for not having an account at a ´Čünancial institution.

.